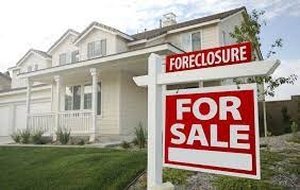

FORECLOSURES

How does a Foreclosure take place?

Phase 1: Payment Default

Payment default occurs when a borrower has missed at least one mortgage payment—although the technical definition can vary by lender. After missing the first payment, the lender will reach out via a letter or telephone.

Typically, mortgage payments are due on the first day of each month, and many lenders offer a grace period until the 15th of the month. After that, the lender may charge a late payment fee and send the missed payment notice.

After the second month of missed payments, the lender will likely follow up via telephone. However, at this point, the lender may be still willing to work with the borrower to make arrangements for catching up on payments, which may include making just one payment to prevent falling further behind.

Once a borrower goes three months without making a payment, the lender generally sends a demand letter (or notice to accelerate) stating the amount in delinquency and that the borrower has 30 days to bring the mortgage current.

A mortgage in default can have three outcomes—return to good standing, be modified, or the property is repossessed or sold via foreclosure or voluntary surrender.

Phase 2: Notice of Default

A notice of default (NOD) is sent after the fourth month of missed payments (90 days past due). This public notice gives the borrower 30 days to remedy past due payments before formally starting the foreclosure process.

Most lenders will not send a notice of default until the borrower is 90 days past due (three consecutive missed payments). Thus, many times a borrower can fall behind a month or two without facing foreclosure.3

Generally, federal law prohibits a lender from starting foreclosure until the borrower is more than 120 days past due.

Phase 3: Notice of Trustee’s Sale

Depending on the state, the process for initiating foreclosure is different. In some states, nonjudicial foreclosures can be done that only requires filing paperwork with the necessary court to start the process. With this, the foreclosure e process can move rather quickly. Other states have judicial foreclosures, which require court approval for each step—meaning the process takes a bit longer.

Once forms are filed with the court or necessary approval is met, the lender’s attorney or foreclosure trustee will schedule a sale of the property. A notice of trustee’s sale (also known as a notice of sale) is then recorded in the county where the property is located—stating the specific time and location for the sale, as well as the minimum opening bid for the property.

The lender must also generally advertise the property (newspaper ads, signs, etc.) in the weeks before the auction indicating that the property will be available at public auction.

The time from the notice of demand to the auction date varies by state, but can be as quick as 2-3 months. Up until the date of the auction the borrower can still make payment arrangements or pay the amount due, including attorney fees incurred by the lender to start the process.

Phase 4: Trustee’s Sale

The property is now placed for public auction and will be awarded to the highest bidder who meets all of the requirements. The lender (or firm representing the lender) will calculate an opening bid based on the value of the outstanding loan and any liens, unpaid taxes, and costs associated with the sale.

When a foreclosed property is purchased, it is up to the buyer to say how long the previous owners may stay in their former home.

Once the highest bidder has been confirmed and the sale is completed, a trustee’s deed upon sale will be provided to the winning bidder. The property is then owned by the purchaser, who is entitled to immediate possession.

Phase 5: Real Estate Owned (REO)

The lender will set a minimum bid, which takes into account the appraised value of the property, the remaining amount due on the mortgage, any other liens, and attorney fees. If the property is not sold during the public auction, the lender will become the owner and attempt to sell the property through a broker or with the assistance of a real estate-owned (REO) asset manager. These properties are often referred to as “bank-owned,” and the lender may remove some of the liens and other expenses in an attempt to make the property more attractive.

Phase 6: Eviction

As soon as the auction ends and a new owner is named—either the auction winner or the bank if the property is not sold—the borrowers are issued an order to evacuate if they are still living in the property. This eviction notice demands that any persons living in the house vacate the premises immediately.

Several days may be provided to allow the occupants sufficient time to leave and remove any personal belongings. Then, typically, the local sheriff or law enforcement will visit the property and remove them and impound any remaining belongings.

How to buy a Foreclosed or Pre-Foreclosure home?

Buying from the Homeowner

![]()

Buying from the Homeowner

A Pre-foreclosure, or short sale, can occur when the homeowner still owns the property and knows there’s a potential for foreclosure. Owners want to sell their home before they end up in foreclosure. This means that short sales aren’t technically foreclosure sales.

Short sales can also prove to be challenging. In a short sale, owners get permission from their lender to sell their residences for less than what they owe on their mortgage. If the owners owe $180,000 on their mortgage, they might still list the home at $160,000 even though such a sale leaves them $20,000 short of being able to pay off their entire mortgage loan.

In some short sales, the owners’ bank agrees to take this loss as a way to get the home sold and the mortgage (which might otherwise go into mortgage default) off their books.

The goal for the owners is to offer their home at a price that’s low enough to ensure a quick sale before they fall behind on their monthly payments. Buying at this stage can be tough, though. Even if the sellers agree to your offer, their bank or lender might reject it if it’s too low.

Buying at an Auction

![]()

Buying at an Auction

The traditional way to buy a foreclosed home is at a real estate auction. At an auction, third-party trustees run a sale of homes that banks or lenders have taken ownership of after the original homeowners defaulted on their mortgage loans.

Buyers can purchase a home quickly (and often for a low price) at an auction. But there are hurdles, too. One example is that an auction typically requires buyers to have cash on hand.

There are also plenty of risks:

- A home you buy at an auction might have a lien on its title from a government agency, especially if the former owners stopped paying property taxes on it.

- A home bought at auction might require expensive repairs.

- You might not have the chance to order an appraisal on the home. During an appraisal, a real estate appraiser determines how much a home is worth in the current housing market. Without an appraisal, you run the risk of paying too much for a home even if you buy it at an auction.

Buying a Government-Owned Property

Buying a Government Owned Property

You might also consider buying government-owned foreclosure properties. These properties are similar to the ones owned by banks or lenders. Government agencies typically take ownership of homes after the owners default on mortgage loans insured by the federal government.

Let’s take a look at an example. When owners stop making payments on a home they financed with an FHA loan, the U.S. Department of Housing and Urban Development (HUD) takes possession of the foreclosed home. Government-owned foreclosures are mostly sold “as-is,” which means that any repairs are your responsibility. In some cases, the government may repair any structural needs before selling, or you could request a repair. You might have to place an offer or bid before viewing or inspecting the home.

Hire an Experienced Real Estate Agent

Hire an Experienced Real Estate Agent

If you decide to go the route of purchasing a foreclosure, you’ll want to find an experienced real estate agent who has access to a local multiple listing service and knows the local market.

This agent can help you determine when a foreclosed home is offered at a bargain price or when it’s listed at an asking price that’s too high for the risk involved. An agent may also help you find foreclosed properties that other buyers might miss.

Additionally, a good real estate agent can discuss challenges you could run into with a foreclosed property. Bear in mind that every state has unique laws and regulations concerning foreclosures. It’s important to work with an expert who understands these laws.